In a market characterized by elevated valuations and geopolitical uncertainty, a disciplined approach to value investing that focuses on high-quality, undervalued companies with strong fundamentals can provide a valuable counterbalance.

In recent years, US market returns have become increasingly reliant on growth plays, driven in large part by technology stocks, even as other sectors offer attractive investment opportunities. A disciplined value approach focuses on fundamentals to identify high-quality companies trading below.

A disciplined value approach focuses on fundamentals to identify high-quality companies trading below fair value. Such companies execute well and grow their earnings and cash flow in line with, or better than, expectations. They tend to generate strong returns, even in markets dominated by growth.

Diversification and strong fundamentals are both key to successful portfolio management, and value strategies can play a crucial role in both regards. Despite the extraordinary performance of growth equities in the past decade, skilled value managers have found undervalued innovators that can compound returns and contribute to portfolio outperformance.

Market uncertainty, cooling US growth

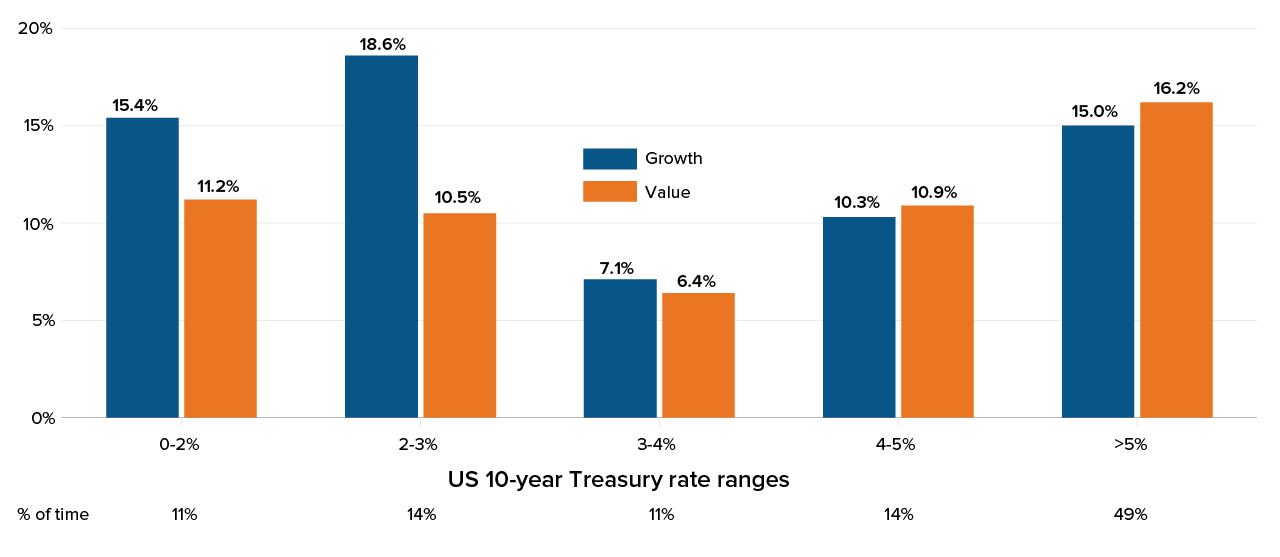

Valuations for both growth and value stocks are highly sensitive to the prevailing interest rate environment. Elevated borrowing costs tend to compress the valuations of growth-oriented companies, which rely more heavily on future earnings. Value stocks — typically with stronger current cash flows — tend to outperform in such environments, enhancing their relative appeal.

Current US trends, such as domestic reindustrialization, evolving geopolitical dynamics and persistent inflationary pressures, are reinforcing expectations of a higher-for-longer interest rate regime.

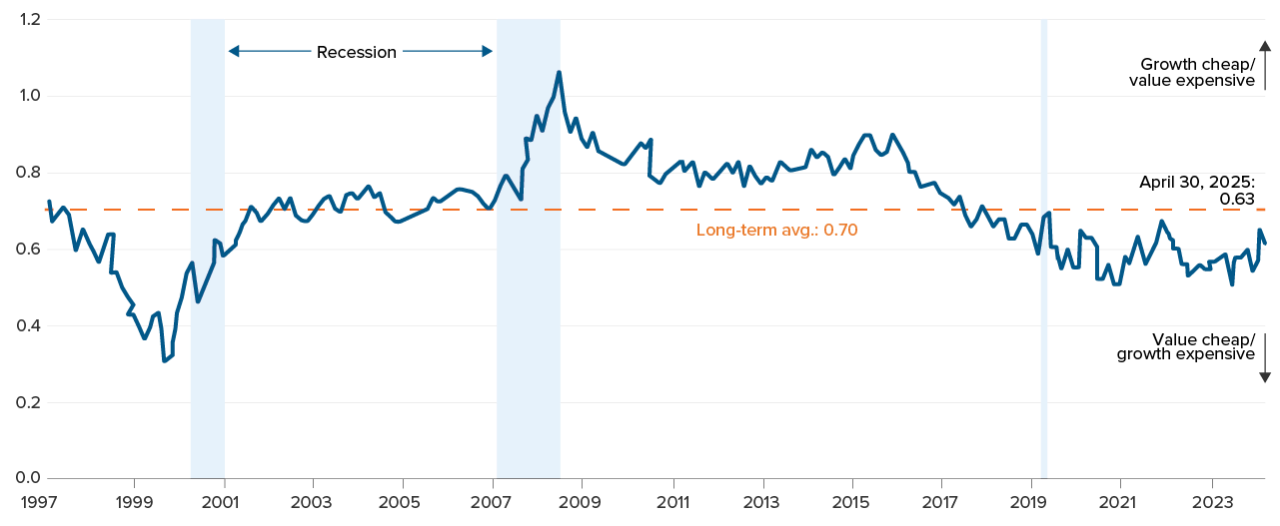

Figure 1 outlines the historical relative valuation of value versus growth stocks, as it rises and falls compared to its long-term average. Recently, growth appears relatively expensive.

FIGURE 1 – Value vs. growth relative valuations

Relative forward P/E ratio of Value vs. Growth, 1997 - present

Source: FactSet, FTSE Russell, NBER, J.P. Morgan Asset Management, as at April 30, 2025.

Source: FactSet, FTSE Russell, NBER, J.P. Morgan Asset Management, as at April 30, 2025.

FIGURE 2 – Value vs. growth in different interest rate environments

Annualized total return by 10-year Treasury rate ranges, 1979 - present

Figure 2 illustrates value and growth performance during different interest rate environments, based on the 10-year US Treasury yield. During lower-rate environments, growth tends to outperform value. However, as interest rates rise, this gap narrows: in a 4%+ interest rate environment, value tends to outperform growth.

Source: FactSet, FTSE Russell, NBER, J.P. Morgan Asset Management, as at March 31, 2025. Growth is represented by the Russell 1000 Growth Index and Value is represented by the Russell 1000 Value Index. Returns are calculated by annualizing the average monthly performance during each interest rate range.

Source: FactSet, FTSE Russell, NBER, J.P. Morgan Asset Management, as at March 31, 2025. Growth is represented by the Russell 1000 Growth Index and Value is represented by the Russell 1000 Value Index. Returns are calculated by annualizing the average monthly performance during each interest rate range.

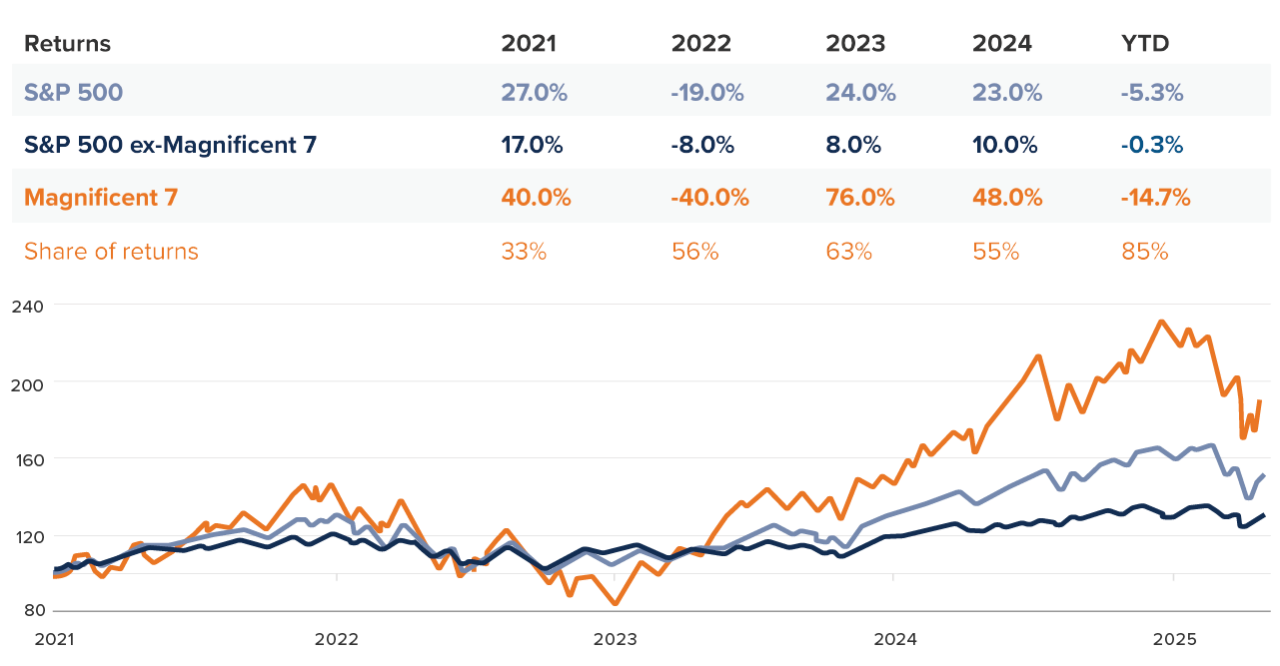

The "Magnificent 7" group of technology stocks have been the driving force behind the returns of the S&P 500 Index over the past three years. In Figure 3, we contrast the performance of this group against the rest of the S&P 500. While these seven stocks contributed 63% of the positive performance in 2023, they also contributed 56% of the negative performance in 2022. A dependence on select growth-oriented stocks is problematic and highlights the need for adequate diversification in investor portfolios.

FIGURE 3 – Performance of “Magnificent 7” stocks in S&P 500

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management, as of April 30, 2025. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Earnings estimates for 2025 are forecasts based on consensus analyst expectations.

Source: FactSet, Standard & Poor’s, J.P. Morgan Asset Management, as of April 30, 2025. Magnificent 7 includes AAPL, AMZN, GOOG, GOOGL, META, MSFT, NVDA and TSLA. Earnings estimates for 2025 are forecasts based on consensus analyst expectations.

Mackenzie US Value Fund: Targeting high-quality, attractively priced companies

Skilled value managers seek innovative companies at relatively inexpensive prices, offering exposure to compounding returns and long-term portfolio performance.

Mackenzie US Value Fund is sub-advised by Putnam Investments’ portfolio managers Darren Jaroch and Lauren DeMore, who each bring decades of experience managing value strategies. They believe undervalued companies with strong fundamentals and consistent cash flow generation can outperform the market over the long term.

While the fund’s benchmark – the Russell 1000 Value index – is reconstituted annually, the team applies daily fundamental analysis to capture opportunities as they arise. Their value universe is composed of stocks that are highly rated by Putnam’s Equity Research Team, as well as the top 20% of securities identified by their proprietary multifactor quantitative model. As a result, non-benchmark holdings have, on average, accounted for 20% of the portfolio over the past three years.1

Building a stock-driven portfolio

Rather than relying on unpredictable economic trends, the team focuses on selecting individual stocks to drive performance in a variety of market conditions.

When evaluating a business, they assess cash flow and shareholder yield, examining how the company deploys its capital to benefit shareholders. They also emphasize relative value — how a stock measures up against its own past performance and to its peers — and thus tailor their valuation methodologies to each company’s business model or industry.

Risk management focuses on amplifying stock risk, while minimizing factor risk. The team’s real-time dashboard allows continuous monitoring of risk exposures, and regular stress tests evaluate portfolio performance under specific market, economic or event-related pressures.

The team typically holds stocks for about five years and steers clear of those with binary "all or nothing" outcomes. Instead, they target stocks with multiple catalysts that can drive value growth over several years.

Diversification for dynamic markets

Value stocks offer investors a compelling opportunity, with more attractive valuations, stronger balance sheets and resilient cash flows. In an environment marked by elevated valuations, interest rate normalization and geopolitical uncertainty, they may provide a margin of safety and often-overlooked growth potential.

Furthermore, during periods of sticky inflation, high-quality companies with more than one path to growth can serve as a hedge to traditional portfolios, as they often have the pricing power to pass increased costs on to consumers.

Historical evidence and recent performance trends suggest that value investing is not merely a defensive strategy, but a resilient and adaptive framework suited to periods of both volatility and recovery. For investors focused on risk-adjusted performance and capital preservation, US value remains a prudent and timely allocation.

1 Source: Putnam Investments, as at March 31, 2025.

Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated.

This document may contain forward-looking information which reflect our or third party current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein. These risks, uncertainties and assumptions include, without limitation, general economic, political and market factors, interest and foreign exchange rates, the volatility of equity and capital markets, business competition, technological change, changes in government regulations, changes in tax laws, unexpected judicial or regulatory proceedings and catastrophic events. Please consider these and other factors carefully and not place undue reliance on forward-looking information. The forward-looking information contained herein is current only as of May 22, 2025. There should be no expectation that such information will in all circumstances be updated, supplemented or revised whether as a result of new information, changing circumstances, future events or otherwise.

The content of this document (including facts, views, opinions, recommendations, descriptions of or references to, products or securities) is not to be used or construed as investment advice, as an offer to sell or the solicitation of an offer to buy, or an endorsement, recommendation or sponsorship of any entity or security cited. Although we endeavour to ensure its accuracy and completeness, we assume no responsibility for any reliance upon it.

Index performance does not include the impact of fees, commissions, and expenses that would be payable by investors in the investment products that seek to track an index.